Solving the Cashflow Conundrum: The Emergence of Fractionalized NFT Music IP and How to Value Future Streaming Royalties

Solving the Cashflow Conundrum: The Emergence of Fractionalized NFT Music IP and How to Value Future Streaming Royalties

The emergence of fractionalized music royalties and Web3 music’s role in making them available has led to an explosion of platforms offering a part of your favorite artist’s track for sale, royalties and all. Whether it’s Rihanna, 3lau, Ashley Wallbridge, or countless others offering a share of earnings as NFTs, this is the new trend, and it’s here to stay.

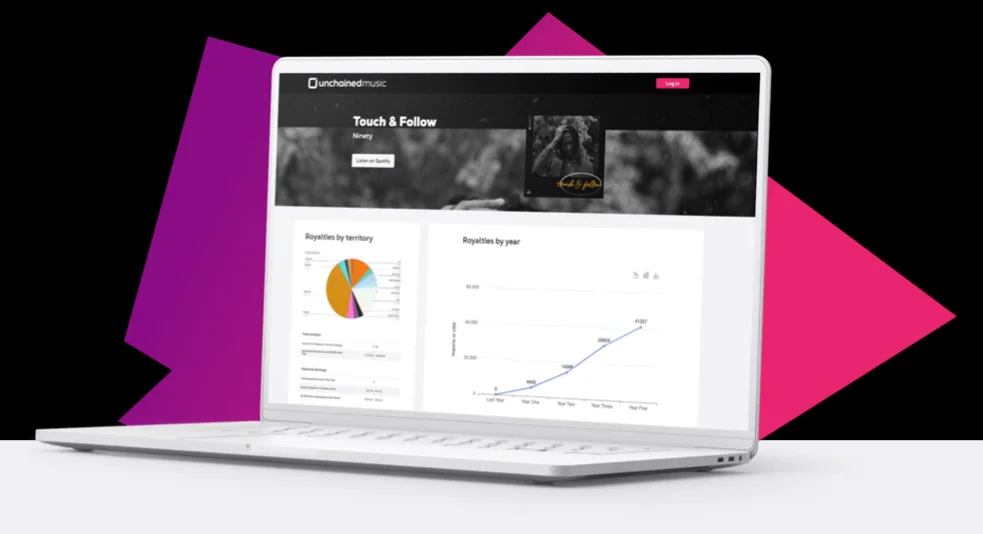

We’ve built a Royalty Prediction Tool for automatically analyzing music IP over at Unchained Music to help with these analyses. Give us a shout if you want to give it a try.

How Spotify Transformed the Music Industry

The ongoing growth in the recorded music industry has been undoubtedly fueled by the expansion of streaming services and digital distribution and has revolutionized the way we consume music. Over the past decade, streaming has become the dominant force in the music industry, with 616.2 million subscribers by mid 2022, overshadowing traditional means such as physical sales and digital downloads. This shift in music consumption has opened new doors for artists, record labels, and investors alike, and saved them from an era of piracy that saw the music industry dip for decades.

These DSPs such as Spotify, Apple Music, and Amazon Music have emerged as the primary source of revenue for the music industry, accounting for roughly 83% of the market overall.

Exploring the Booming Market of Music Royalty Investment

As DSPs continue to grow, private equity and music investment funds are placing substantial bets on future song royalties. One prominent example is the Hipgnosis Songs Fund, which has been actively acquiring music rights from high-profile songwriters and artists. It’s no wonder. Catalog hits give regular and predictable cash flow, so investment becomes a simple numbers game. It’s a good deal for both sides, if the IP is valued fairly. Artists and songwriters gain financial stability, while investors can capitalize on the steady cash flows from music royalties.

With billions of dollars on the line, it’s not a big deal to hire an expensive CPA (Certified Public Accountant) or five, ensuring that the lucrative nature of these deals is properly taken advantage of. It’s no wonder that there is an arms race, attracting an influx of capital from investment firms and high-net-worth individuals who are eager to secure a share of the expanding music royalties market.

Enter Music NFTs

As DSPs continue to grow, innovative music NFT companies are capitalizing on fractionalization, allowing investors and fans alike to own smaller percentages of the music IP. You don’t need to be a fund with millions of dollars in your back pocket. $80 will do.

These platforms enable artists and rights holders to tokenize their music IP, making it accessible to a broader range of investors, bringing a real-world asset on-chain, and ensuring liquidity, which is sorely lacking within the traditional music IP investment landscape.

Broken Records: The Perpetual Cash Flow Problem

When deals are worth hundreds of millions of dollars, Blackrock has no issue investing in a high-powered accountant to analyze future cash flow by putting pen to paper and looking at the historic performance of an artist, per-stream rates, royalty reports, and everything else that could influence the valuation of a deal.

As Royal.io pointed out in a well-done blog by Jay Srivastav, analyses as to initial price and future cash flow are complicated, especially when you’re providing predictions to NFT holders. Price your NFTs too high, and returns are lower than hoped for. Price them too low, and you’re leaving money on the table for the company and the artist.

How can you analyze future cash flow without knowing the exact earning rates from each artist?

Artists and Genres Are Not Created Equal

The problems we run into when valuing a track for a fractionalized drop or traditional acquisition are manyfold:

Streams are unequal across the world

While many artists talk about getting $0.003 per stream on Spotify on average, that’s one of the better scenarios. You’ll get $0.003 per stream, but only in the USA and parts of Europe. A subscription for Spotify is $10.00 in the US but only $1.45 in India. Every country has their own prices for DSPs, and with streaming royalties coming out of the subscription pot, it of course makes sense that streams from India would pay less than streams from the USA.

This doesn’t even start to touch on variations in stream rates between independent music distributors, Merlin, and the majors.

If you have a fanbase that predominantly resides in North Africa and the Middle East, you’re in an objectively weaker financial position than an artist that’s just across the Mediterranean Sea with a fanbase in Italy and France.

This means you can’t purely rely on average per-stream rates.

Followers are Cheap

If you know where to look, it’s easy to manipulate stream and follower counts. Artists are being caught left and right being engaged in streaming fraud or payola, including significant pay-for-playlist placement. How are they caught? Sudden spikes in traffic, sudden massive amounts of playlist adds, and overwhelming incoming listeners from countries known to have bot farms.

This means you can’t rely on streams alone. You need to look at trends, averages, spikes, organic conversation.

Companies Have Limited Data During Valuations

While selling a song, the artist has one point of leverage—they know exactly what their song has been making over its release history and how much they make on average for a million streams. These music IP companies don’t, and they have to make a really good estimate based on what they know about the genre, and based on proxy tracks.

This means you’re guessing for catalog tracks, and it gets worse…

New Releases Have No Data

When it comes to investing in music IP, new releases present a unique challenge due to the lack of historical streaming data. With no track record to analyze, predicting the potential success and long-term cash flows of a newly released song or album becomes considerably more difficult. However, this uncertainty also brings the potential for significant rewards if the music outperforms expectations. For investors who have a strong understanding of the industry, as well as the ability to identify emerging trends and talent, betting on new releases can be a strategic move.

Aka. you’re gambling with your music taste.

Genres Matter

The genre of a song or album plays a critical role in determining its valuation within the music IP investment landscape. Different genres have unique consumption patterns, fan demographics, and growth trajectories, all influencing the potential for revenue generation and long-term returns. For instance, rap and hip-hop songs often experience more substantial fan bases in the USA, France, and the Netherlands, while AfroBeats, while extremely popular, tends to be more distributed in its listener base, leading towards a lower weighted per stream rate for artists producing in that genre.

Future Events, Releases, and Collaborations

Future events and performances are significant factors that can influence the value of music IP. Live shows, festivals, award ceremonies, and media appearances all contribute to an artist's overall visibility and public appeal, which in turn affect the consumption of their music and the potential revenue generated from their catalog. As an artist's profile rises, so does the demand for their music, leading to increased streaming numbers and higher royalty payouts for rights holders.

There’s no better example of this than Rihanna’s catalog. Post-Superbowl, she saw an average 231% week over week increase for the songs that she performed. That bump isn’t a flash in the pan, and in partnership with her tour and increased visibility, the halftime performance significantly increased the value of the drop Deputy did in partnership with AnotherBlock for a portion of Bitch Better Have My Money (Disclosure: We do the initial royalty analyses for all drops with AnotherBlock, including Bitch Better Have My Money).

For investors in music IP, keeping a close eye on an artist's upcoming events and performances can provide valuable insight into potential growth opportunities. A well-timed investment before a major tour, album release, or high-profile media appearance can increase returns as the artist's music gains traction and their fan base expands. Additionally, collaborations with other prominent artists or inclusion in popular playlists and media can boost an artist's reach and contribute to the overall value of their music IP.

So How Do We Actually Forecast Returns on Music IP?

There are two main models that we tend to see with releases.

One, a track by an established artist will release, and generally, within the first year, we are able to recognize a streaming peak, and then plot a decay curve from there. Two, an artist releases a track, and it slowly builds over the course of its first year or until it blows up on TIkTok, and then it decays.

Either way, we’re able to look at historic streams once a track has hit its streaming peak, and plot out a curve that when taken with per-country, per-dsp, and per-stream rates weighted by listener base, gives us an accurate estimate within a few percentage points one way or another—without seeing the streaming reports from the artist.

It’s good to also be a distributor and have this first-party data.

Pretty cool huh?

New tracks are still high risk, high reward. There’s no data, but if you trust your musical taste, you might stumble upon a hit.

Addressing the Cashflow Problem

To bring this full circle, it’s fine and dandy to hire a CPA that costs $250-400/hr to evaluate a catalog worth millions. That’s a rounding error. It’s another thing to be able to analyze thousands of individual tracks that each require the same diligence. It’d be a full-time job if you’re an individual.

Fully understanding how much streaming royalties music IP will pay over time, let alone actually running the individual calculations and analyses, is time-prohibitive, cost-prohibitive, and leads to an imbalance of power between the company, artist, and investors. That is assuming you can can even get industry standard per-stream rates, keep them updated, measure out marketshare by DSP, and correctly weight each track’s listener base.

The Good News About Analyzing Streaming Royalties

For anyone who is fractionalizing music IP, needs to look at their future streaming royalty cashflow, or evaluate whether a particular project is a good investment, we’ve built a Streaming Royalty Prediction Tool that evens the playing field, incorporating and automating everything we chatted about above.

Musicians, know what your IP is worth.

Investors, find the returns you want with objective data.

Companies, don’t leave money on the table with your drops.

Send me an email, and I’ll personally get you set up with a demo. Free.